Clear objectives and a strong company strategy are necessary for navigating the commercial world. Analyzing strategic options is essential. These many strategies aid in a company’s achievement of its objectives. They are crucial to effective strategic management and planning because they create a foundation for stakeholder satisfaction and competitive advantage.

In this journey, we will delve into strategic alternatives in a business plan and their role in shaping robust business strategies. Our goal is to offer advice on making informed decisions and evaluating strategic alternatives. It’s about finding the best alternative to ensure profitability and shareholder returns.

Join us as we investigate how to plan your company’s course, engage in successful competition, and adjust to the strategies that are always changing in the market. Let’s uncover how to capitalize on opportunities and mitigate risks in the pursuit of successful strategic management.

Understanding Strategic Alternatives in Business Plan

What are Strategic Alternatives?

Strategic alternatives are different options that a business can choose to meet its goals. Some common strategic alternatives in a business plan are expanding into new markets, adding new products, mergers, takeovers, and partnerships. Evaluating alternatives helps companies pick the best path forward. It lets them weigh the pros and cons of different choices.

How it Aligns with the Goals and Objectives of a Business:

- Picking alternatives that match short and long-term goals is key. It keeps plans focused.

- Alternatives should move the business closer to objectives. Like growing market reach or profits.

- Metrics help track progress. Is a new market increasing sales as projected?

- Compare alternatives to see which fits goals best. Ensure they align before moving forward.

- Gaps appear when current options miss key goals. It signals a need for new alternatives.

Alignment keeps plans on track. It lets leaders pick options to strategically hit targets.

Why are Strategic Alternatives Important for Business Success?

- Weighing options forces move beyond the status quo to drive growth.

- Analysis uncovers risks so companies can prepare.

- Seeing multiple paths allows seizing opportunities as conditions change.

- Leaders can make bold strategic shifts to gain an edge.

- Regular evaluation gives the flexibility to pivot when needed.

Without assessing options, firms hit roadblocks. Alternatives let them route around issues. They allow smart risk-taking. Companies must scan the horizon. They need visibility to emerging routes. Evaluating alternatives powers informed choices. It provides potential paths for progress.

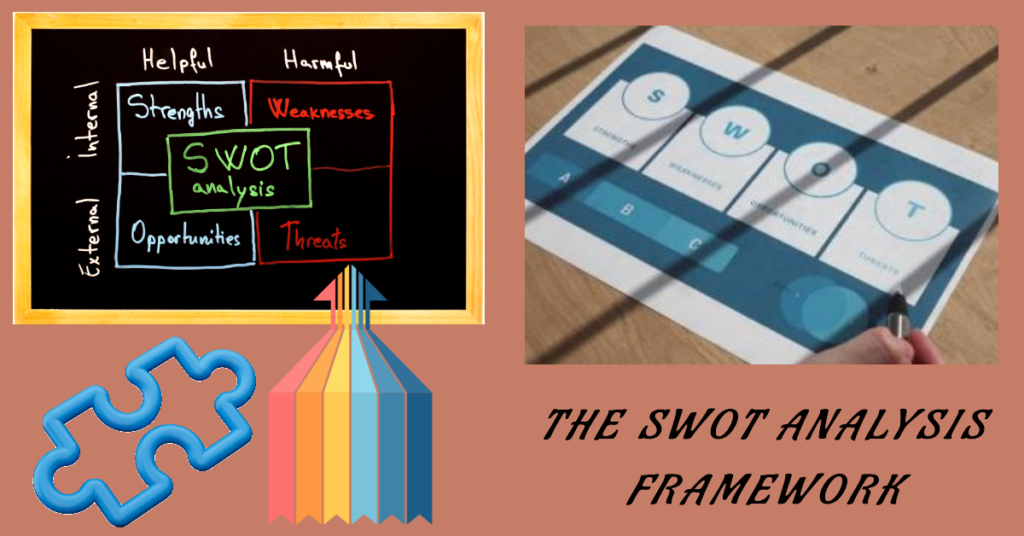

The SWOT Analysis Framework: A Strategic Beacon

SWOT analysis is a useful strategic planning tool to evaluate alternatives. It identifies internal strengths and weaknesses. It also looks at external opportunities and threats. Conducting a SWOT analysis helps businesses in several ways:

- It assesses the current strategic position based on concrete factors.

- The insights it provides allow businesses to leverage strengths and mitigate weaknesses.

- By revealing potential threats, it helps businesses prepare contingency plans.

- Looking at opportunities allows seizing promising openings at the right time.

SWOT has four elements that provide a comprehensive picture:

- Strengths: Internal attributes like human talent, IP, processes, and brand equity.

- Weaknesses: Internal gaps like inadequate capacity, lack of skills, and high costs.

- Opportunities: External potential upsides like unmet customer needs, new markets, and partnerships.

- Threats: External hazards like new regulations, shifting technology, and increased competition.

SWOT’s Role in Strategic Alternatives:

- Informed Decision-Making:

- SWOT provides a detailed overview, aiding in the selection of the best alternative.

- It ensures the chosen strategic alternatives align with the business’s capabilities and the market landscape.

- Achieving Competitive Advantage:

- Businesses may carve themselves a distinct niche in the market by capitalizing on their advantages and capabilities.

- It promotes the creation of plans that set a company apart from rivals and guarantee its enduring prosperity and profitability.

Types of Strategic Alternatives in a Business Plan

Market Penetration:

Market penetration focuses on increasing market share for existing products in their current markets.

- It typically involves tactics like increased marketing, lower prices, and more distribution channels.

- The goal is to drive growth by reaching and selling to more customers within existing segments.

- Pros are relatively low risk and quick implementation. Cons are lack of diversification and reliance on existing products.

- Examples include boosting marketing spend to gain share or expanding distributors.

Product Development:

Product development means creating new products and services to offer existing customers and markets.

- This leverages existing competencies but expands offerings to provide fresh value.

- Risks include high development costs and uncertain demand. Rewards include diversified revenue streams.

- Risks and Rewards: Balancing innovation with market acceptance is crucial.

- Pace of innovation must match customer needs and tech trends. Offerings should build on current strengths.

- Examples include R&D efforts, new feature development, and entering new segments.

Market Development:

Market development brings current offerings into new markets and customer segments.

- Diversification into new demographics, distribution channels, and geographic regions.

- Reduces reliance on existing markets while expanding consumer and audience reach.

- Requires market research to identify and effectively engage new opportunities.

- Examples include entering new countries, new distribution channels, and product repositioning.

Diversification:

Diversification expands offerings and markets simultaneously.

- Involves new products for new segments, expanding the business scope.

- Mitigates risk of a slowing market by broadening into multiple streams.

- Should fit cohesively with the core business to maximize existing capabilities.

- Examples include technology firms expanding into hardware and software.

Acquisition:

Acquiring competitors and complementary businesses can fuel growth.

- Provides quick access to new capabilities, offerings, customers, and market share.

- Risks include high acquisition costs and integration challenges.

- Aligns best when the target company augments current weaknesses and fits culturally.

- Examples include merging with a competitor or buying a tech startup.

Restructuring:

Restructuring overhauls internal organization, operations, and staffing.

- Used to reduce inefficiencies, streamline processes, and optimize operations.

- Improves resource allocation, decision-making, innovation, and accountability.

- Risks include the temporary decline in productivity and morale challenges.

- Examples include reorganizing business units, consolidation, and headcount optimization.

Divestment/Liquidation:

Divestment involves selling off assets, units, or entire parts of the business.

- Sheds low-performing segments to focus on more profitable activities.

- Provides influx of capital from sale which can fuel more strategic goals.

- Carries the risk of valuable capability loss and buyer uncertainty.

- Examples include selling an underperforming business unit.

How to Develop Strategic Alternatives for Your Business:

- Research the industry trends, competitors, and market deeply.

- Look internally at strengths, weaknesses, and resources (SWOT).

- Brainstorm possibilities like new markets, products, and deals.

- Judge strategic fit and feasibility to filter options.

- Analyze risks, returns, and costs of remaining alternatives.

- Gather input from key internal and external stakeholders.

- Weigh the pros and cons. Measure against goals.

- Pick 1-2 best options with the highest potential.

Developing alternatives takes work. Leaders must study the landscape. They need insights to craft options tailored to their strategy. With diligent efforts, they can design pathways aligned with objectives. On the chosen route, progress awaits.

Brief Mention of Stakeholders and Their Role in Strategic Alternatives:

- Leadership weighs in based on priorities. Investors on profits. Staff on company culture.

- Stakeholder views provide a wider lens to assess each alternative.

- Their input reveals blind spots. It highlights the pros, cons, and tradeoffs.

- Engaging stakeholders enables well-rounded decisions.

- It aligns the path with diverse needs across the business.

Stakeholders hold pieces to the puzzle. Their perspectives enlighten strategic thinking. Collaboration evaluates all angles. Smooth integration depends on inclusion. United around decisions, stakeholders help guide the way forward.

Frequently Asked Questions – FAQs

A business plan’s executive summary, company overview, market analysis, competitor analysis, marketing plan, operations plan, and finance plan are its main parts.

Strategic alternatives for a business are identified through research, SWOT analysis, brainstorming sessions, and evaluating options like entering new markets or offering new products.

Business objectives are specific goals, while strategic alternatives are different options to achieve those goals.

Strategic alternatives like expanding into new markets or acquiring competitors can fuel business growth if chosen and implemented effectively.

Risks with strategic alternatives include high costs, inadequate ROI, poor integration, and opportunity costs from pursuing losing propositions.

Choosing the optimal strategic alternative can strengthen competitive advantage by improving strategic positioning and differentiation.

The purpose of strategic alternatives in a business plan is to evaluate different courses of action to achieve goals and select the best path forward.

Strategic alternatives provide flexibility to change course and pivot strategies to adapt to evolving market conditions.

Businesses choose the best alternative through analysis of factors like feasibility, risk, costs, ROI, alignment with objectives, and competitive impact.

Conclusion

In wrapping up, exploring strategic alternatives is a vital component of business success. Evaluating options in depth provides avenues to make prudent moves that strengthen competitive advantage.

Leaders must adopt a broad perspective when assessing multiple courses of action. Consider insights from analysis as well as stakeholder needs. Develop metrics that map to overarching goals. With diligence and foresight, companies can pivot strategies to capitalize on emerging opportunities.

Strategic alternatives empower businesses to make progress amid evolving conditions. They allow adapting with agility to shape advantageous positioning in the market. Commit to regularly re-evaluating alternatives as a navigation tool. Keep the end destination in focus, but be open to choosing a better route. With alternatives in their toolkit, leaders can make informed decisions to propel their company forward.

The road brings twists, but opportunities exist around each turn. Alternatives provide the fuel, flexibility, and sightlines needed for the journey. Companies willing to explore options and make bold moves at the right moments can gain sustainable market footholds. Assess, analyze, and decide – a continuous cycle driving strategic management success.